corporate tax increase proposal

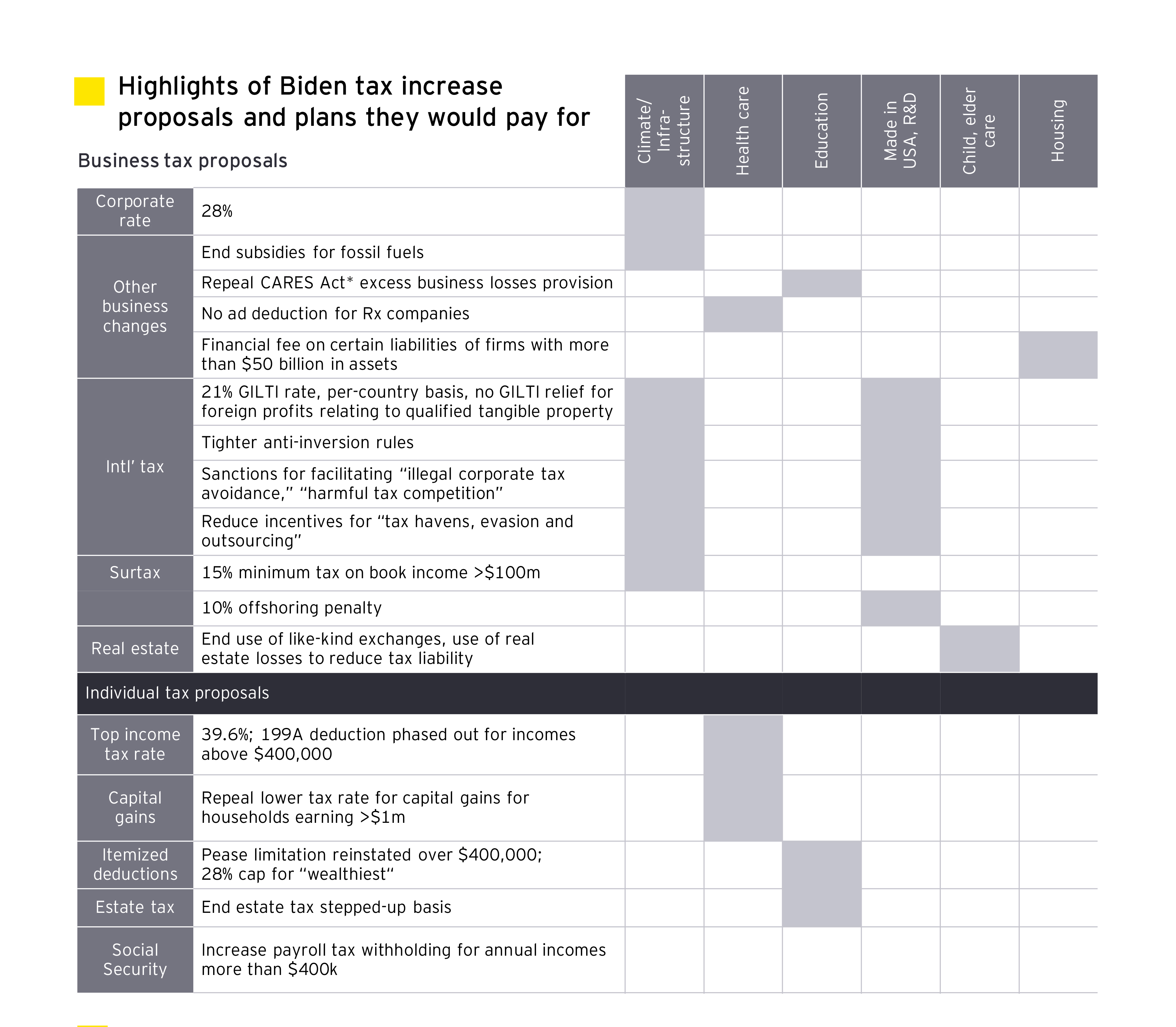

Increase the corporate tax rate to 28 percent from the current 21 percent rate. February 24 2021.

Tag Archive Corporate Taxes American Enterprise Institute Aei

The Democratic proposal would raise the top corporate tax rate from 21 to 265 less than the 28 Biden had sought people familiar with the matter said Sunday night.

. Minimum Tax on Corporate Profits. Revenue provisions in the proposed budget prominently include what an administration fact sheet calls a new billionaire minimum income tax of 20 on both realized. At Budget 2020 the government announced that the Corporation Tax main rate for all profits except ring fence profits for the years starting 1 April 2020 and 2021 would be.

President Biden and congressional policymakers have proposed several changes to the corporate income tax including raising the rate from 21. 9 rows The proposed budget also creates several minimum taxes that would greatly increase complexity. The White House wants to increase the minimum tax on US.

Corporate Tax Rate From 21 to 28. Corporations to 21 up from the 105 that Trumps 2017 tax cuts introduced. Evaluating Proposals to Increase the Corporate Tax Rate and Levy a Minimum Tax on Corporate Book Income Key Findings President Joe Biden and congressional policymakers.

Biden would require companies to. Ways and Means Committee Chairman Richard Neal has proposed 25 new tax policies that would on net raise taxes on US. Ad Stop guessing and get data-driven insights about how your business proposal actually works.

New details of a Democratic plan to enact a 15 minimum corporate tax on declared income of large corporations were released Tuesday by three senators. Proposed Increase of the US. The House proposal would take huge steps to reverse the 2017 Republican tax cuts.

It would hike the corporate rate to 265 after the GOP slashed it to 21 from 35. The planned increase in April 2023 to the corporation tax rate from 19 to 25 for companies. Increasing top tax rates for individuals.

President Bidens tax proposal would. The tax plan would raise the corporate rate to 28 percent from 21 percent to help fund the presidents economic agenda. Corporations by 9636 billion over the next.

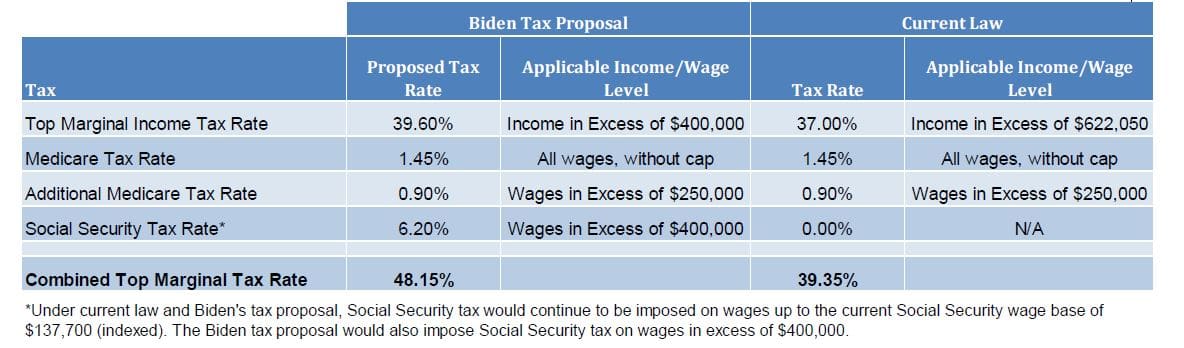

Award-winning sales enablement tool to manage present share and track your sales content. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in. The Federal governments 2023 fiscal year that begins on October 1 2022 includes a proposal to increase.

In our new book Options for Reforming Americas Tax Code 20 we illustrate the economic distributional and revenue trade-offs of 70 tax changes including President Bidens. The increase in the corporate tax rate in the USA and the consequences for companies. Enact a new 15 percent minimum tax on book income.

The BBBAs plan for increased tax equity includes a 15 minimum tax on corporate profits of 1 billion or more reported to. The proposal suggests an increase in the corporate tax rate from 21 to 28. Democratic presidential candidate Joe Biden has promised not to raise taxes on anyone making less than 400000 a year but his proposal to raise the corporate tax rate.

Biden S Tax Proposal And Potential Impact On Executive Compensation And Stock Ownership Meridian

Who Will Be The Biggest Losers From Biden S Tax Hikes

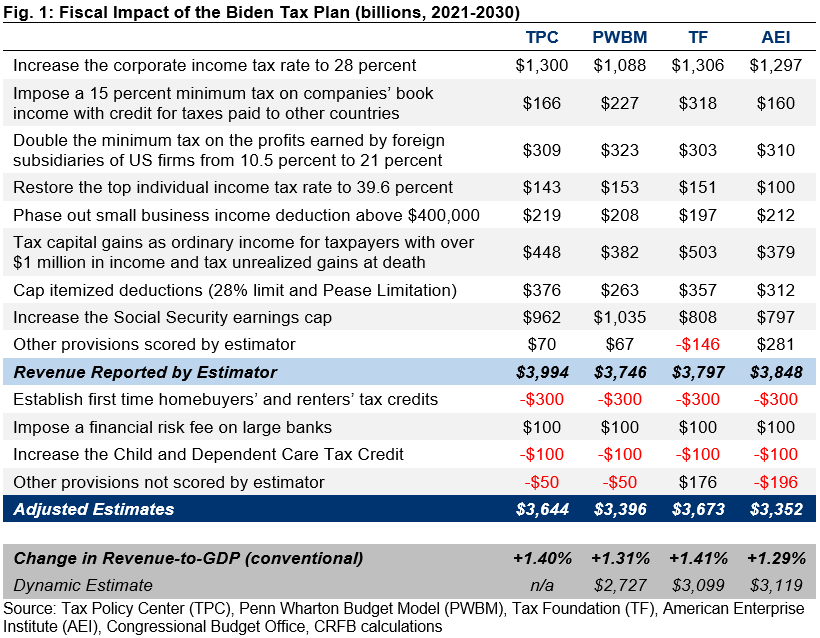

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

How Biden S 2 Trillion In Tax Increases Target Companies And The Rich The New York Times

In The Long Run Vetoed Tax Bill Would Have Ladled Out More Corporate Tax Breaks Northstar Policy Action

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

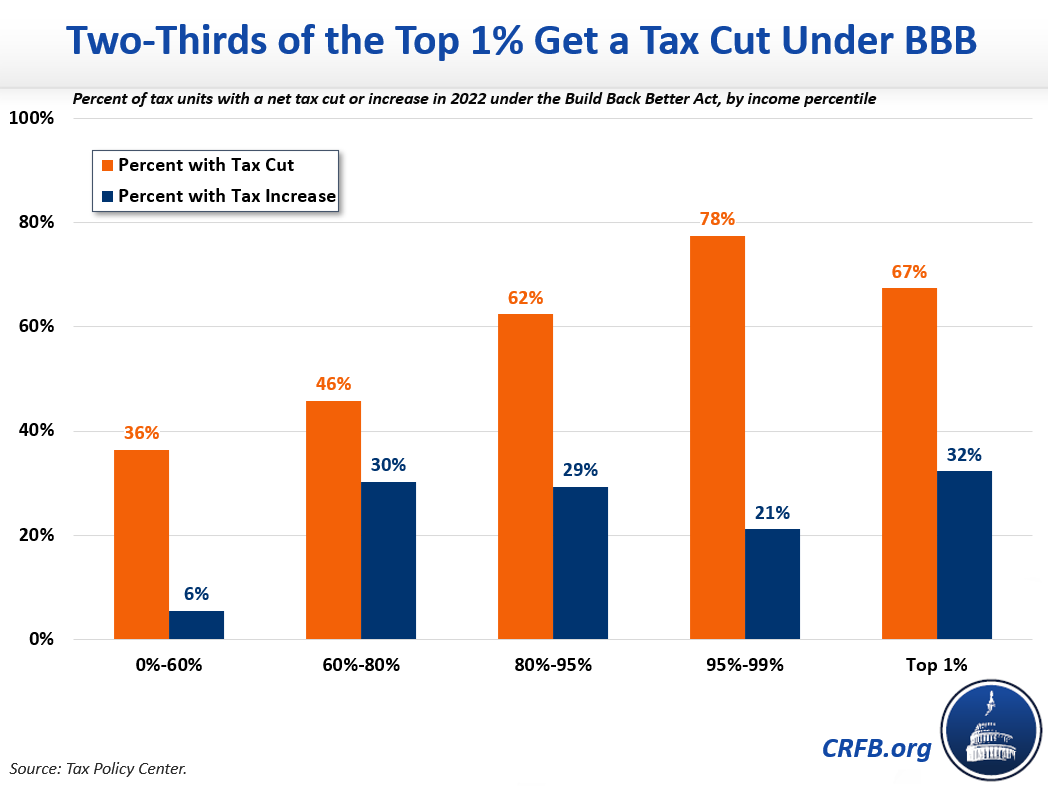

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

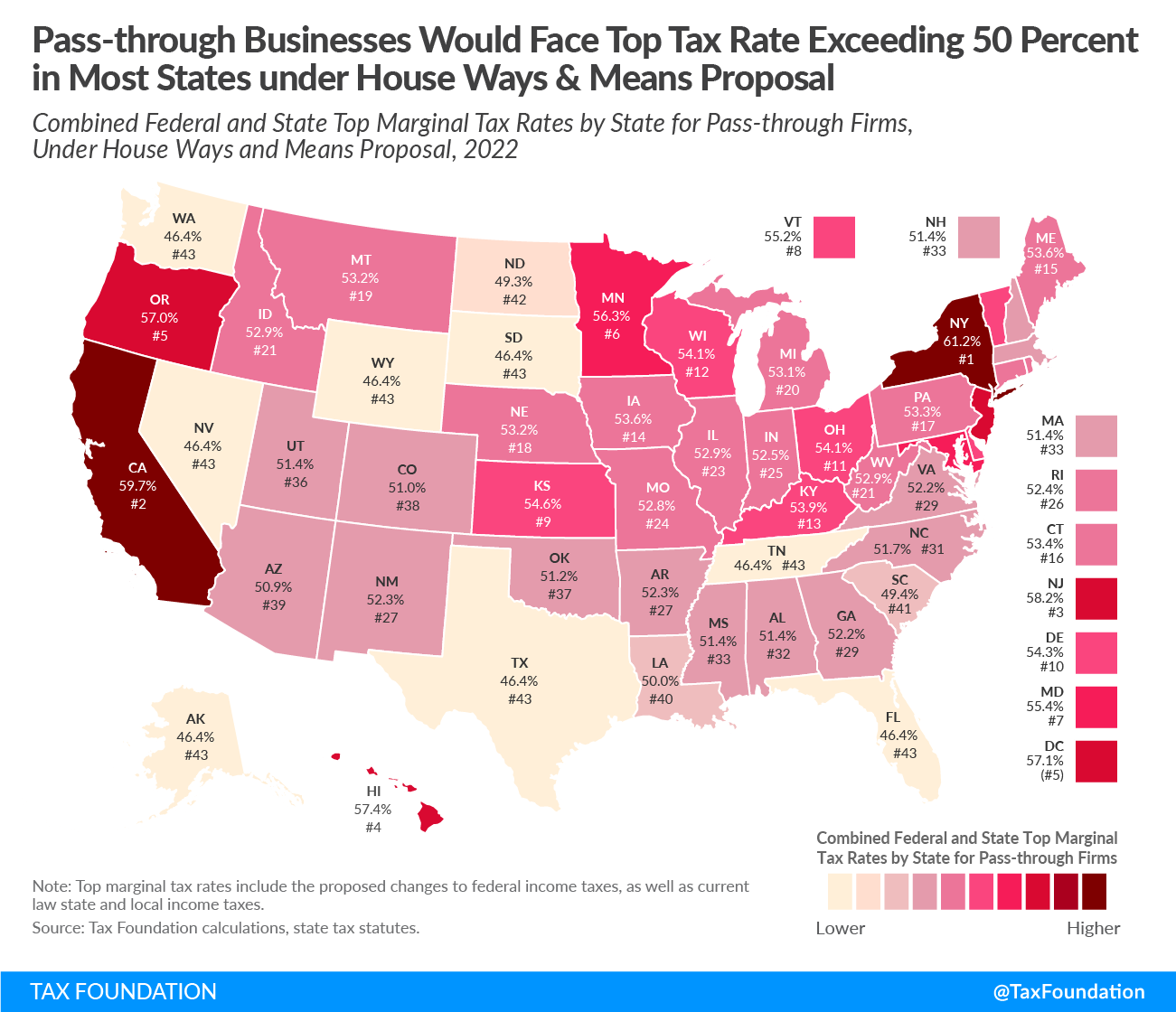

House Democrats Pass Through Business Tax Tax Foundation

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

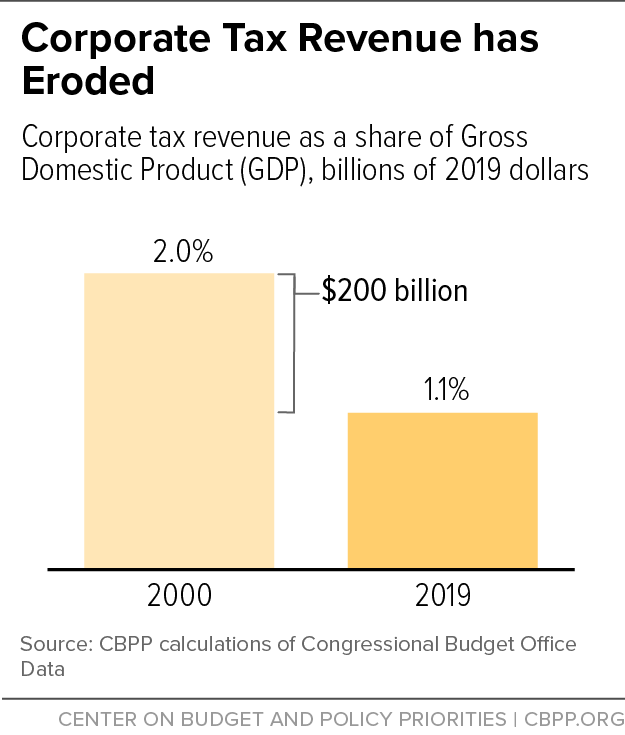

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

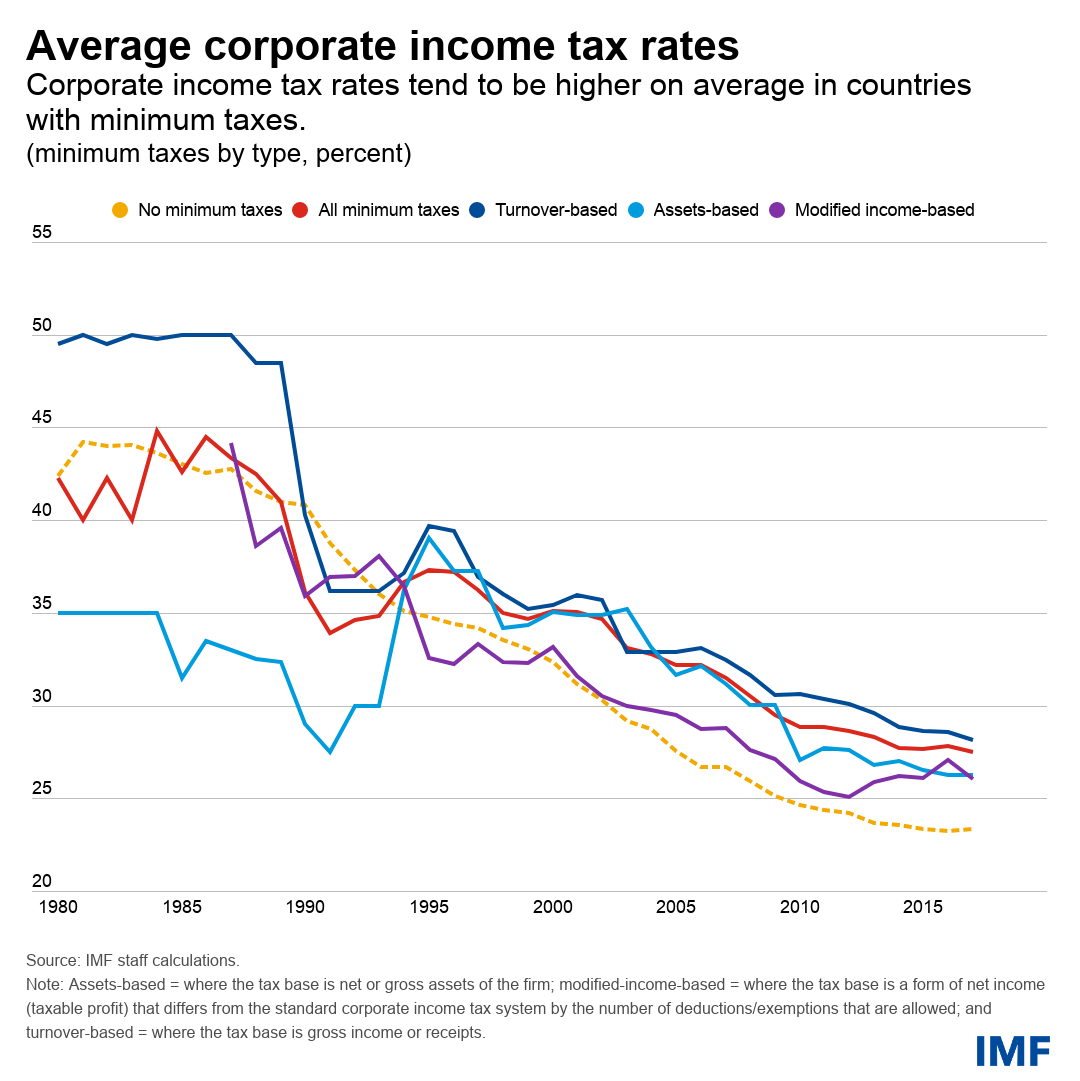

The Benefits Of Setting A Lower Limit On Corporate Taxation

Post 2020 Tax Policy Possibilities Ey Us

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

What Do Federal Tax Proposals Mean For Solar Valuations

Six Economic Facts On International Corporate Taxation

Flawed Data From House Leadership Attempts To Hide Tax Hikes Under Proposal Itep

Presidential Tax Rate Proposal Mullin Barens Sanford Financial